Brazilians Bullish on U.S. and U.K. Currencies Despite Ditching U.S. Dollar Backing in New Chinese Trade Deal

Tracking Global Events | 3 April 2023

On March 29th, China and Brazil struck an agreement to conduct trade in their respective currencies, moving away from the U.S. dollar, the traditional choice for cross-border trade. The move is significant, given that China is Brazil’s largest trading partner, with over $150 billion in trade last year. Brazil’s new president has welcomed closer relations with China, which has put those in Washington on edge. To better understand Brazilians’ perception on trade, China, and global currencies, Premise launched a sentiment survey across the country.

![]()

Insights

- A majority (52%) of Brazilians approve of President Luiz Inácio Lula da Silva’s administration of Brazil.

- Knowledge of the China-Brazil trade deal was low, with only 33% of Brazilians aware of the country’s plans to ditch the US Dollar in trade with China

- When asked if they agreed with the plan, only 42% of Brazilians supported the move to ditch the dollar. 30% opposed the move and 28% had no opinion.

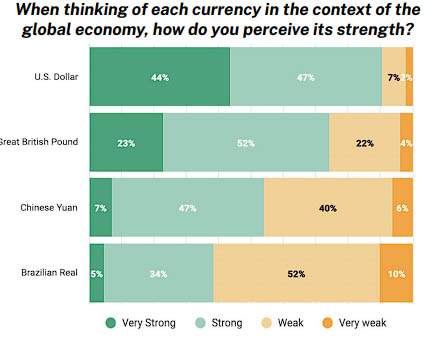

- On perceptions of global currencies, Brazilians overwhelmingly perceived the U.S. dollar as the strongest currency, closely followed by the Great British Pound. Respondents were relatively split on the strength of the Chinese Yuan but were least optimistic about the strength of the local currency, the Real.

- Despite a majority of Brazilians (62%) expecting President Lula to seek closer ties with China, 67% would prefer the United States to be Brazil’s closest partner, 16% would prefer China, 14% would prefer the U.K., and only 3% would prefer Russia.

- In the Chinese-Brazilian trade relationship, most Brazilians see the largest advantage of trading with China to be cheaper products (30%). Other noteworthy findings: 19% saw benefits to accessing the vast Chinese market, 15% believed it could bring rapid technological improvement, and a further 15% believed it would help Brazilians access more products. On the other hand, only 5% perceived the advantage being “good quality products”.

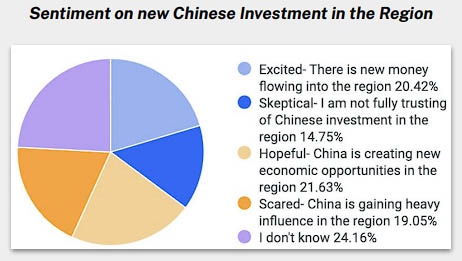

- Brazilians were mixed when asked about China’s rising economic influence in the region. When asked to reflect on the fact that In 2002, Chinese trade with Latin America and the Caribbean was just $18 billion; in 2022 it was $450 billion, nearly 35% of Brazilians were either scared or skeptical of the growth in trade, while around 41% were either excited or hopeful. Most interestingly, 24% responded “I don’t know,” suggesting is still a sizeable population in Brazil who have not made up their minds about China.

Methodology

From 30 March 2023 to 2 April 2023, Premise surveyed a stratified sample of 2,322 adults, representative by age, gender, and geography across Brazil. Post-stratification weights were applied to align the demographics of the actual sample with the target population based on region, age, and gender.

Premise in Action

Premise offers a unique ability to quickly source information from real people on the ground in hard-to-reach places. Over five million people in 140 countries are using the Premise app on their smartphones, enabling our customers to monitor a situation over time and employ a data-driven approach to timely decision-making.