In emerging markets such as Latin America (LATAM), Africa or Asia the banking system is very different than in the United States. Global payments are complex because the financial landscape of each region varies. Not only is the financial landscape is different but there are political, cultural and structural differences that need to be considered.

The global economy is changing and with those changes come new ways for people to earn money. Big name players such as Uber, Lyft and GrubHub are shaping the landscape of the gig economy. Gig work, once a trend is now a lifestyle worldwide where people can work on their own time to earn money, buy groceries, pay rent and more.

Premise currently operates in 48 countries worldwide with over hundreds of thousands of Contributors. Paying our Contributors in a timely manner and through their preferred method is one of our strengths as a company. Handling payments in many countries can be a challenge as each market is different and many emerging markets are broken. Therefore we adapt to our users to provide the best experience for them.

But operating globally requires paying globally which can be difficult if you aren’t aware of the challenges it can pose. Exchange rates and fees can be burdensome when applied to the money being made by gig workers. Many companies are inhibited from implementing operations globally due to the difficulty of payments.

At Premise, we are able to help our Contributors by helping them earn money by completing tasks which would not be possible without our global payment expertise. We strive to tailor our payment options to each country creating an added value in what we do. We’ve found that many of our users in Asia, LATAM and Africa don’t have bank accounts because people in rural areas often can’t pay the bank fees required to open an account or hold one over time. As well, many bank accounts will not allow users to hold USD currency but only local currency.

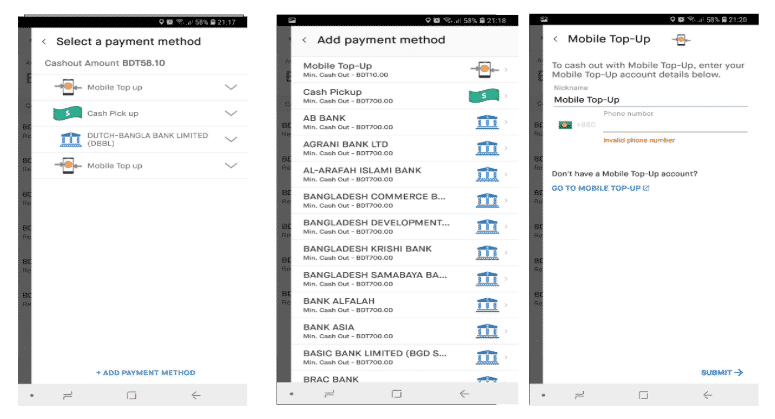

User view in the Premise App of the payment options

We operate in many local currencies and offer different payout options for our networks around the globe. To do so we scout local providers that can help us deliver a targeted solution, such as Mobile Top Up.

What is Mobile Top Up? It is the ability to receive data plans and/or internet service on your cell phone. This a good benefit in Africa and LATAM as many people have a prepaid mobile service where their data plan is independent from their internet service.

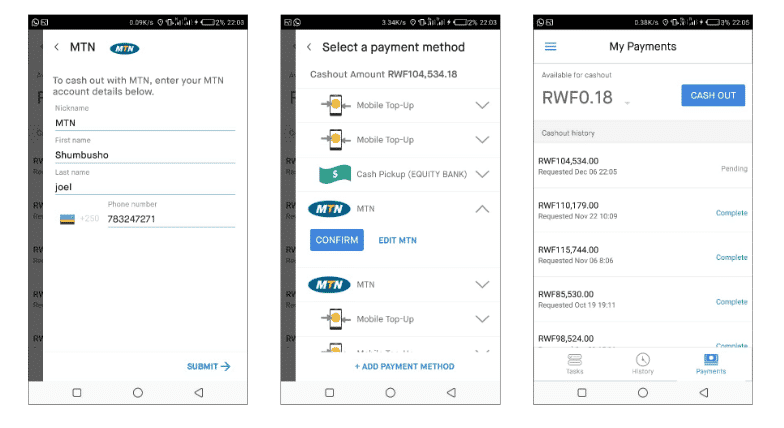

User view in the Premise App of a region the offers Mobile Top Up as a payment options

Premise is proud to partner with top payment providers which helps us operate in some of the most difficult places around the globe like Venezuela. Using a variety of payment providers makes the payment process in our App as seamless as possible for our Contributors. We understand the global challenges of payments but with our expertise, we are happy to face them.

Through Premise many of our Contributors are now financially stronger and have now an additional source of income. We enjoy hearing great testimonies of the impact we have done but also how they have impacted us. Premise is proud to be a global company and we will push to higher grounds.

Crowdsourcing data from local markets provides unique insight into the ground level economic, political and cultural climate in countries around the world. Working in emerging markets and remote areas can be difficult but we’ve seen the profound impact of collecting ground level data from these areas. Even though paying Contributors around the world is just one aspect of understanding their lifestyles, it is one that enables Premise to collect high-quality granular data in near-real time.