Social distancing ordinances, mandatory mask-wearing policies, and continued lockdowns have significantly and negatively affected the operations of salons, spas and beauty retail shops across the country. But even inside the home, it seems that many have been opting to skip out on their daily makeup, hair care and skin care routines. With nowhere to go—and ample Zoom and Instagram filters—the reasons for getting made up these days are fewer.

This combination of retail and service shutdowns, as well as changing personal care regimens, has upended the global beauty industry—with sales plummeting by about 30% and stock prices of major beauty manufacturers similarly taking a nose-dive during the pandemic.

A central question for the personal care industry now is how and exactly why consumer habits have changed. Perhaps more importantly, manufacturers wonder whether or not changing personal care practices will continue after the COVID-19 pandemic. Will a more natural appearance prevail even after we return to the workplace and mask-wearing policies are loosened? Moreover, similar to questions circulating in other industries, what will the return to the “new normal” look like?

In September 2020, Premise used its network of female contributors across the United States to answer these questions and glean insights around beauty product use and shopping behavior both before and during the COVID-19 pandemic.

Personal Care Product Use Down

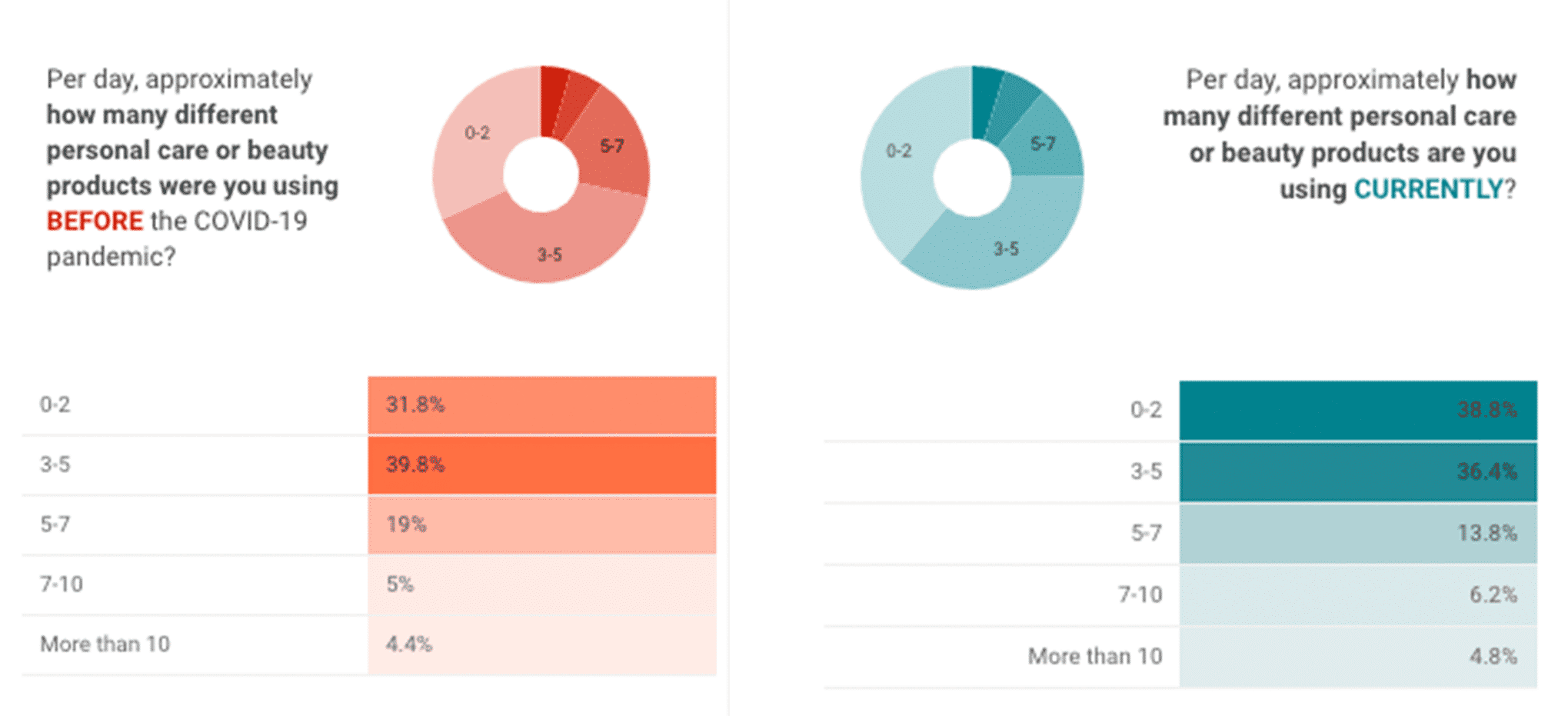

The trends in the data are clear. Whereas before the COVID-19 pandemic respondents used an average of three to five personal care products per day, the plurality of respondents now use zero to two products on a daily basis.

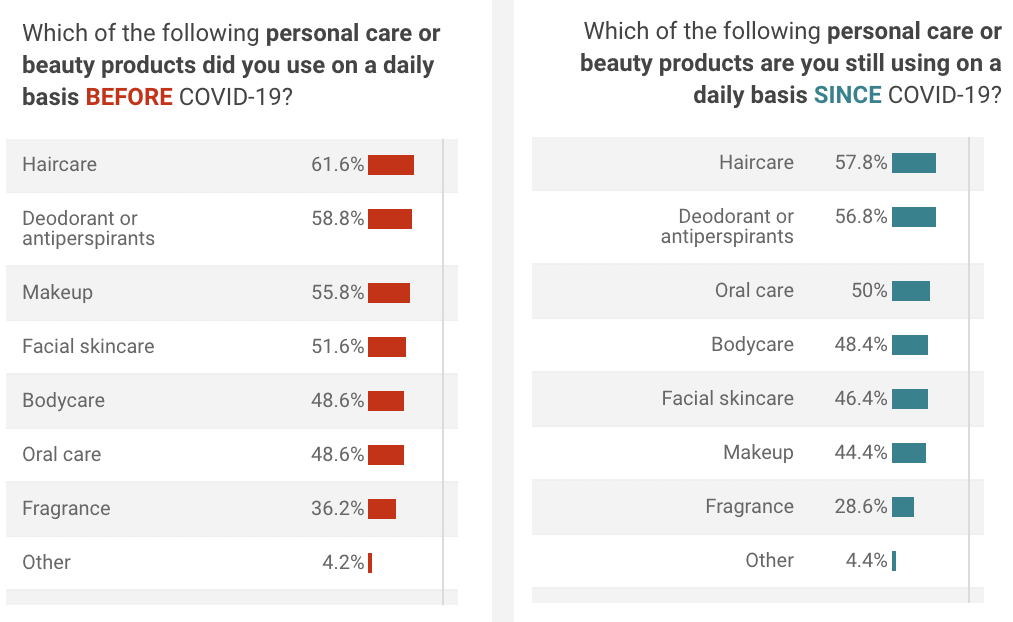

The drops in daily product use are especially notable in makeup, facial skin care, and fragrance products, whereas oral care, deodorant or antiperspirant, and hair care products have remained fairly stable during the pandemic. This means there has not only been a shift in the number of products women are using, but also in the types they are using.

Changing Makeup Routines

Regarding specific makeup goods, before COVID-19, the survey found that the daily most-used makeup item by contributors was mascara. Since the advent of the pandemic, however, mascara use has dropped by more than 12 percentage points. The top spot on the makeup front is now held by lip balm, which 48% use daily, trailed by mascara (36% ), foundation (33%), eyeliner (23%) and concealer (22.6%).

Regarding specific makeup goods, before COVID-19, the survey found that the daily most-used makeup item by contributors was mascara. Since the advent of the pandemic, however, mascara use has dropped by more than 12 percentage points. The top spot on the makeup front is now held by lip balm, which 48% use daily, trailed by mascara (36% ), foundation (33%), eyeliner (23%) and concealer (22.6%).

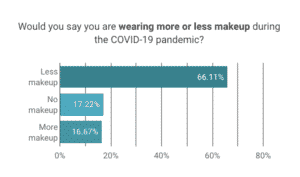

The vast majority of respondents—66%—said they are currently wearing less makeup than they used to, with 17% answering they are no longer wearing any makeup at all. Only 16% say they are wearing more makeup than six months ago.

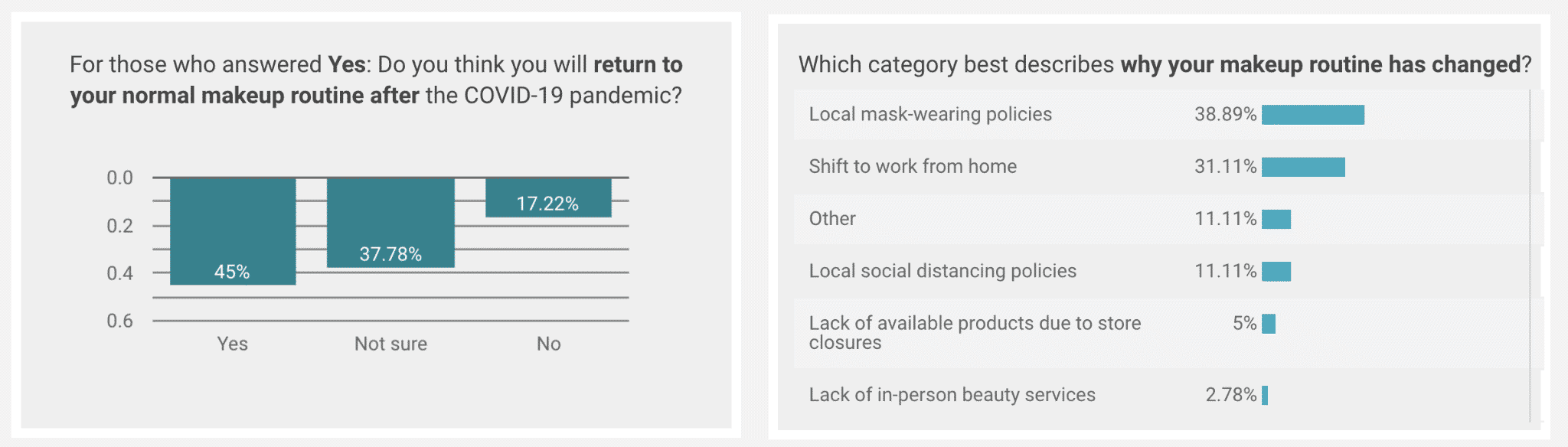

Why have makeup routines changed? Nearly 39% say this is due to local mask-wearing policies, followed by a shift to working from home (31%) and local social distancing policies (11%). Of the nearly 40% who answered that the pandemic has affected their normal makeup routine, a staggering 55% said they will not or are not yet sure that they will return to their normal makeup routine. This suggests that coronavirus may have fundamentally altered women’s relationships with beauty products.

In line with these responses, Premise found that 33% of respondents now spend less on personal care products in comparison to their spending prior to the pandemic. Moreover, like other industries, consumers are now buying their favorite products online more frequently, and as a result, are spending less in big box stores and drugstores.

Conclusion

Although definitive answers as to what the “new normal” will look like are still outstanding, consumer attitudes and preferences in the beauty world are changing rapidly. Makeup use is waning, and the eventual return to pre-pandemic makeup and skin care routines by consumers is still uncertain.

If you’re interested in using our technology to identify consumer behavior, email us at [email protected].

Visit us at www.premise.com/COVID-19 to follow along with our COVID-19 coverage.

Data Source: Premise Data | Data was collected between September 16-18, 2020 from 500 female contributors.